Insurers paid out a record $ 132 Billion for economic losses from global natural disasters: time to act

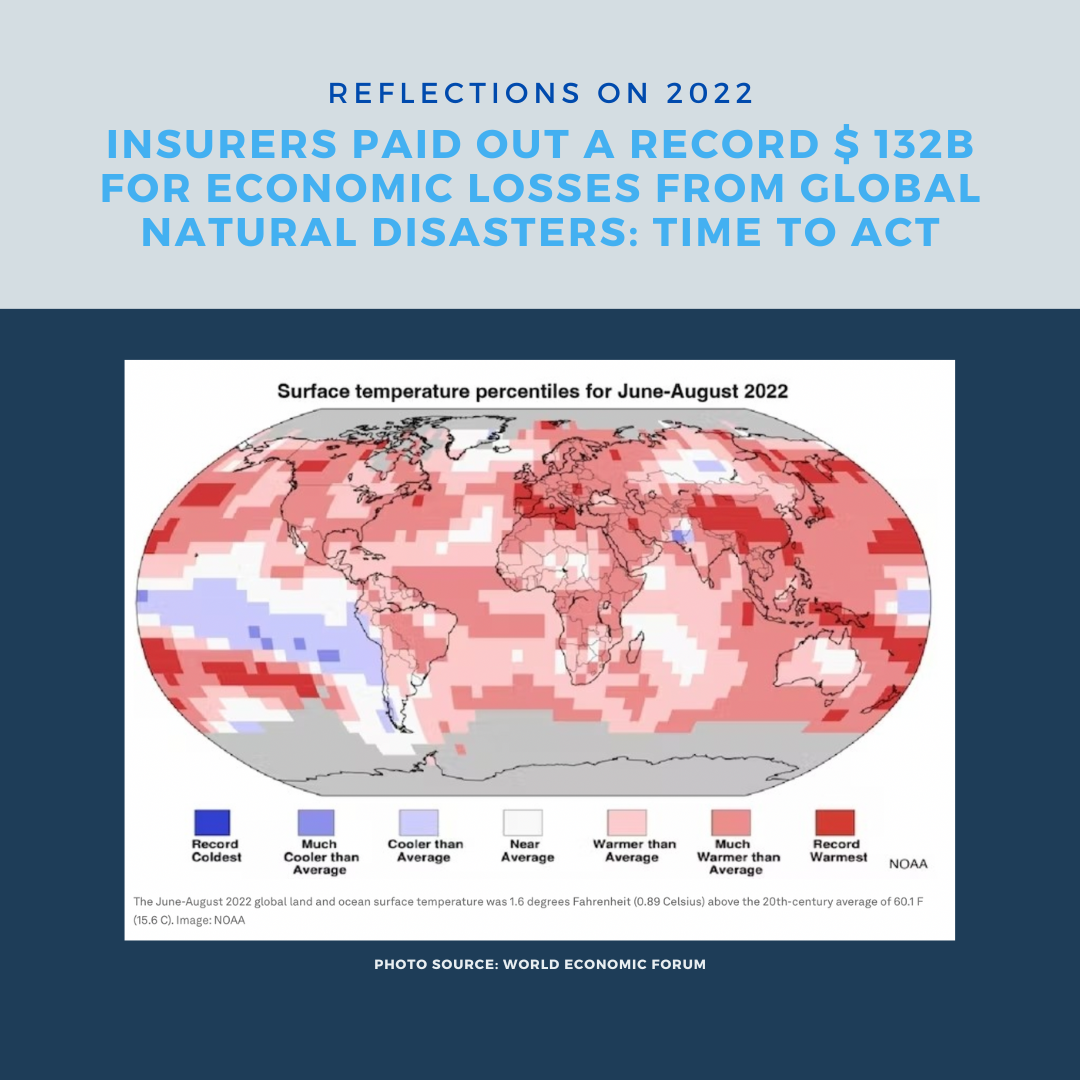

AON(1) estimates that economic losses from global natural disasters in 2022 reached $ 313 billion. Of these, insurers covered $132 billion: ranking 2022 as the fifth costliest year for insurers on record. The range of extreme weather events included floods, droughts, earthquakes, typhoons and heatwaves. Floods were the deadliest and accounted for 88.4 per cent of total deaths globally(2). As a snapshot: in Pakistan floods affected 33 million people and caused 1,739 deaths while in Bangladesh and India floods affected 7.2 million and 1.3 million people, respectively. Though on a smaller scale, floods in the Democratic Republic of Congo killed 169 people and affected nearly 40,000 people. Major droughts in the United States, Europe and China went on record as being among the top ten costliest disasters of 2022.

The scale, complexity and interconnectivity of extreme climatic events in 2022 underpins the role of climate change and pre-existing vulnerability of the most affected communities. To put this in perspective: in Indonesia and Afghanistan, the devastating earthquakes mostly affected communities living near their epicenters. Indonesia sits on the Pacific Ring of Fire, while Afghanistan lies on the Alpide belt. Consequently, the Afghanistan earthquake claimed 1,000 lives(3).

Reflecting on these disasters within a global protection gap of 58% presents an opportunity for (re)insurers both public and private to collaborate in increasing protection of the most vulnerable while increasing global resilience. The year 2023 is the year to make a difference: it is time to act. One promising area is in forward-looking and avant-garde simulation based modelling for multiple perils. Another is cohesive and coherent proactive financing of climatic disasters through instruments such as the Global Shield against Climate Risk to name a few global initiatives.

[1] AON. 2023 Weather, Climate and Catastrophe Insight

[2] & [3] 2022: A year when disasters compounded and cascaded