05

Oct

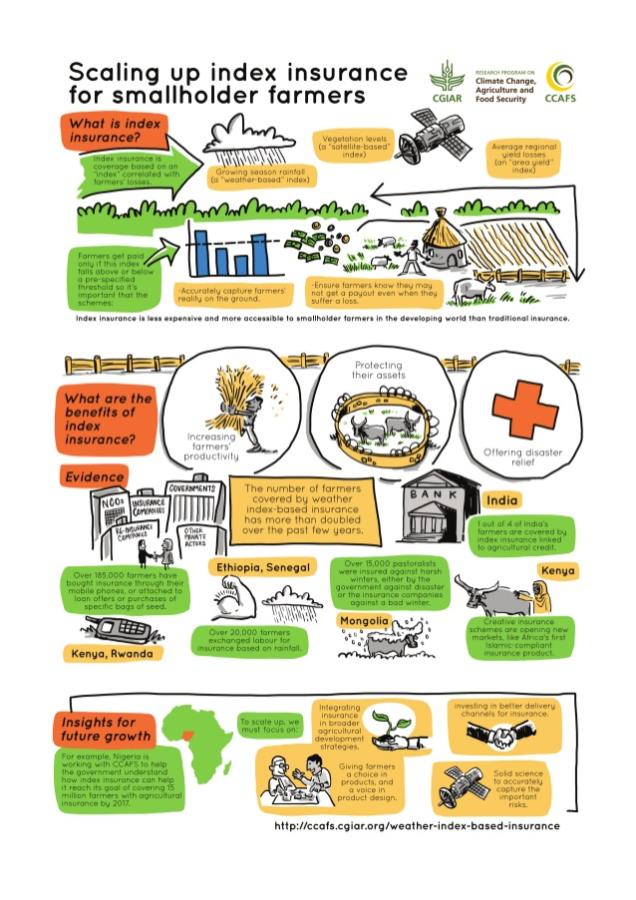

Vanessa Meadu at University of Copenhagen's CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS) has created a colorful, comprehensive infographic that explains how index insurance could help millions of smallholder farmers fight back against climate change. For more information about the CGIAR and CCAFS, please visit their Linkedin Group at https://www.linkedin.com/company/cgiar-climate. More great presentations like this one can also be found at http://www.slideshare.net/cgiarclimate/ccafs-index-insurance-infographi….