Published on:

Topics:

Country:

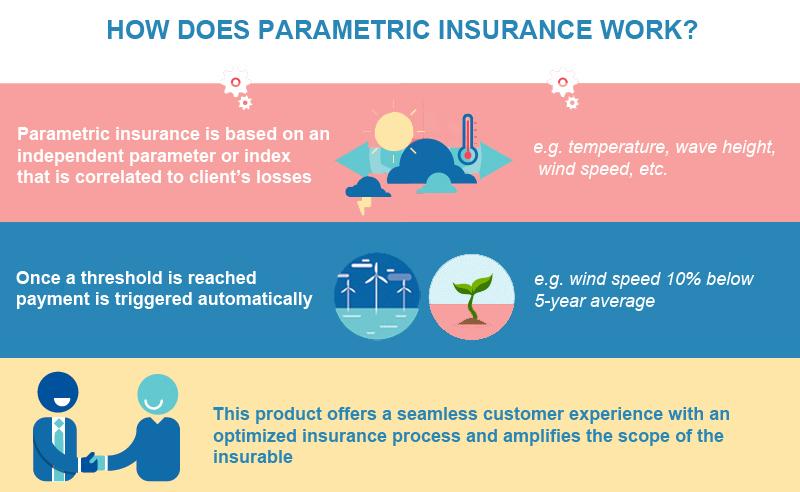

Sompo Japan Nipponkoa Insurance will start selling insurance products that compensate farmers hit by drought in Indonesia as early as this fall, Asian Nikkei Review reports. With a premium of 50,000 rupiahs ($3.76), contract farmers will be entitled to be compensated 500,000 rupiahs if a drought occurs, the newspaper also details.