Agriculture is a source of employment for nearly 50% of adult population in Bangladesh contributing to 13% of GDP in 2019. The country is highly exposed to climate change risks: cyclones, floods, droughts and saltwater inundation due to tidal surges. Notably, the 2007 Cyclone Sidr caused $18 million loss in livestock and over $415 million in crop production . Farmers in Tangail suffered millions of losses from Gopalganj flood this year. According to a WBG study , high water stress due to rising temperatures will affect the yield of Aman and Boro rice, the country’s two major staple crops, with

South Asia

MoooFarm is an award-winning start-up building a connected commerce platform to lift India’s 100 million dairy farmers out of poverty and ensure nutritious milk for over a billion people. Through its mobile application farmers can connect with qualified veterinarians, buy & sell cattle, order farm inputs, access financial services, manage their farm & cattle and engage with subject matter experts to make dairy profitable. MoooFarm was awarded under the Data & Analytics category in the GIIF Agriculture Insurtech Challenge 2019. Watch the interivew video here.

GIIF organized an agriculture Insuretech innovation challenge/competition as a part of an Insuretech fair, hosted in Mumbai, India in July 2019. Through this innovation fair, the GIIF aims at improving the understanding of Insuretech, supporting the integration of different technology solutions with agriculture insurance, and applying innovation with actual programs on the ground. The Awards recognized some of South and South-East Asia and Pacific's most promising entrepreneurs who are using technology to address challenges in providing agricultural insurance to farmers. The awards were given

29

Apr

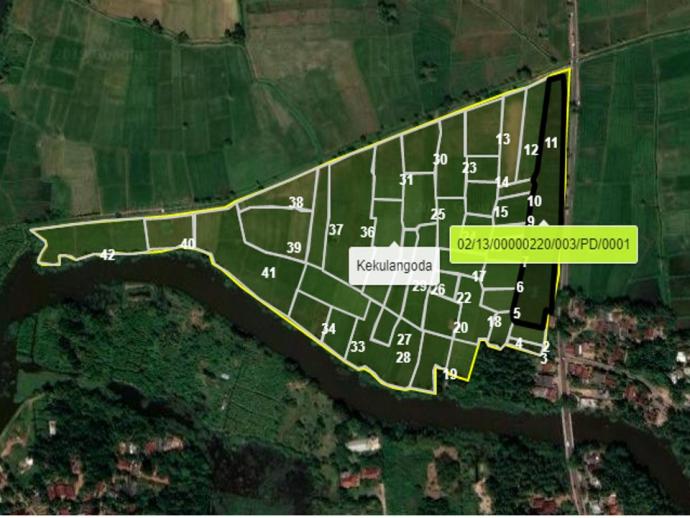

The AAIB, Sri Lanka’s national agricultural insurer, partnered with the International Finance Corporation (IFC) to modernize agricultural insurance provision in the country. Kasundari, the Team Lead for the project, joined us to share their experience in digitizing agricultural information as part of this project. Background Imagine having to walk through a paddy tract consisting of hundreds of small fields in a rural area, sometimes without proper roads, seeking to identify a particular paddy of land. The mission is to verify an insurance claim in that field. For insurers offering traditional

Published on:

July 9, 2019; Mumbai (INDIA): The Global Index Insurance Facility (GIIF) and Sankalp Forum by Intellecap, announced the winners of Agriculture Insuretech Innovation Challenge at the Agri Insuretech Forum that took place at the Taj Mahal Hotel in Mumbai today. Of the world’s 500 million smallholder farmers, around 400 million are in Asia. The region is home to some of the world’s most climate-exposed territories and has been disproportionately hit by the effects of climate change, and farmers are suffering from crop failures that can threaten their economic livelihood. The Global Index

Content owner:

The Global Index Insurance Facility conducted video interviews with donors, guest speakers, and participants at the GIIF Agriculture Insuretech Forum 2019 in Mumbai, India. All videos are listed here .

The linkage between agriculture and climate change is undeniable. Any change in the climate has significant effects on crop yields and livestock, which intensifies the agriculture sector’s vulnerability to weather and disaster risks. More frequent extreme weather events and natural disasters distress the poor and the vulnerable most heavily and, as a result, agricultural and index-based insurance products have increasingly been regarded as significant tools for smallholder farmers to protect themselves from financial losses. As we know, insurance normally provides valuable access to credit and

Content owner:

The linkage between agriculture and climate change is undeniable. Any change in the climate has significant effects on crop yields and livestock, which intensifies the agriculture sector’s vulnerability to weather and disaster risks. More frequent extreme weather events and natural disasters distress the poor and the vulnerable most heavily and, as a result, agricultural and index-based insurance products have increasingly been regarded as significant tools for smallholder farmers to protect themselves from financial losses. As we know, insurance normally provides valuable access to credit and

8

Jul

Topics:

The potential of agriculture and insurance is greatly restricted by many challenges faced throughout the product lifecycle - from product design to client delivery to claim processing. Insuretech, at the intersection of insurance and technology, holds the potential to overcome those challenges and transform the insurance landscape. Integrating Insuretech innovations with agriculture insurance promises to enhance product design, improve sales and distribution, facilitate premium collection, and optimize servicing and claims processing. To leverage innovative solutions, the Global Index

The high transaction costs of serving low-income clients in developing and emerging market economies demand innovative approaches and technological advancements. Challenges that inflate operational costs include data collection, processing and management, premium payment mechanisms as well as claims verification and settlement. Index insurance products, mobile payment devices or more accurate weather and agricultural-yield information based on satellite data are examples of innovative approaches that can help to overcome these challenges.