Content owner:

Topics:

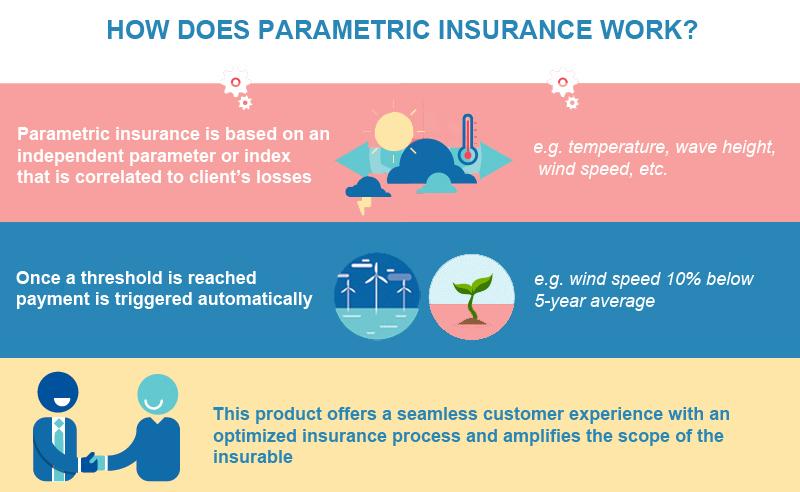

"Significant crop shortfalls observed in various parts of the globe in recent years have had an adverse impact not only on the agricultural sector of countries but also on many other economic sectors related to agriculture, such as logistics, storage, and processing industries," a Swiss Re Corporate Solutions' publication concludes. In "Insuring Crops of Countries and States with Weather Index Solutions", Swiss Re suggests index insurance be a good tool for states and countries to protect their agricultural sector from weather risks due to the product's high efficiency and light administrative